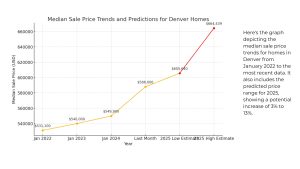

It’s that time of year when we start predicting what’s in store for the next year for everything from sports and entertainment to the economy, interest rates and the real estate market. A prediction is a statement about what we think will happen in the future, and the truth is we can certainly guess but we certainly don’t know exactly what will happen. Case in point, recent predictions in various news reports about appreciation rates in Denver in 2025 have stated we can expect anywhere between 3% and 13% appreciation next year; that’s a big swing.

Although we can’t know yet what will happen next year, there are a few things we do know at this point.

Inventory:

We know current inventory levels are higher and average days on market is longer in Central Denver than they are in the surrounding suburbs. This is a shift from how the Denver market typically performs; historically, the neighborhoods in Central Denver experience the most stable conditions in the market while the surrounding suburbs tend to fluctuate based on market conditions. This reversed trend depicts a shift towards a balanced or a buyers’ market.

Interest rates and buyer demand:

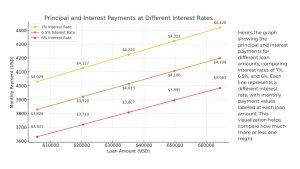

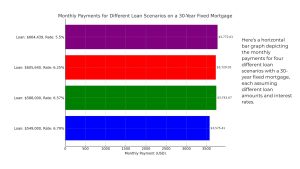

We know, contrary to buyers’ hopes, interest rates are not likely to drastically decrease to the 3-4% range anytime soon. Many economists believe that interest rates will end up in the low to mid 6% range for the entirety of 2025 (and yes, this is a prediction). We also know there is a risk for those buyers who continue to wait for interest rates to go down; as prices continue to rise, any gain in a lower interest rate will likely be negated by a higher home price once these buyers enter the market.

Home prices and affordability:

We know home prices continue to rise albeit at a slower pace than they did in the past few years. Multiple offer situations are still happening especially for well-priced homes new to the market as well as homes that have been languishing on the market and recently reduced their prices. Affordability has been a challenge for a segment of the buyer pool as they grapple with higher interest rates and exorbitant insurance costs.

While these conditions may not seem ideal to those planning a move in 2025, all is not lost. Inventory is up, giving buyers more choice and additional leverage in negotiating with sellers, especially when it comes to inspections. Sellers generally have equity to work with when they move, so moving into a home with a higher interest rate may not be as painful as initially anticipated. If sellers and buyers can let go of the expectations of lower prices and lower interest rates to focus on the current market conditions, they can be successful in their moving processes. The trends supporting a more balanced market are a welcome change and indicate that 2025 could be a solid year for the real estate market in Denver. It will be interesting to see if the predictions turn into reality.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link