As the real estate market continues to evolve, a new challenge is emerging that both buyers and sellers need to navigate – rising insurance costs. The insurance landscape is changing, impacting the affordability and attractiveness of properties, and I’ve seen firsthand the effects of these increasing costs on both sides of the transaction. I’ll delve into the causes behind the surge and provide insights on how buyers and sellers can adapt in this shifting market.

Understanding the Surge

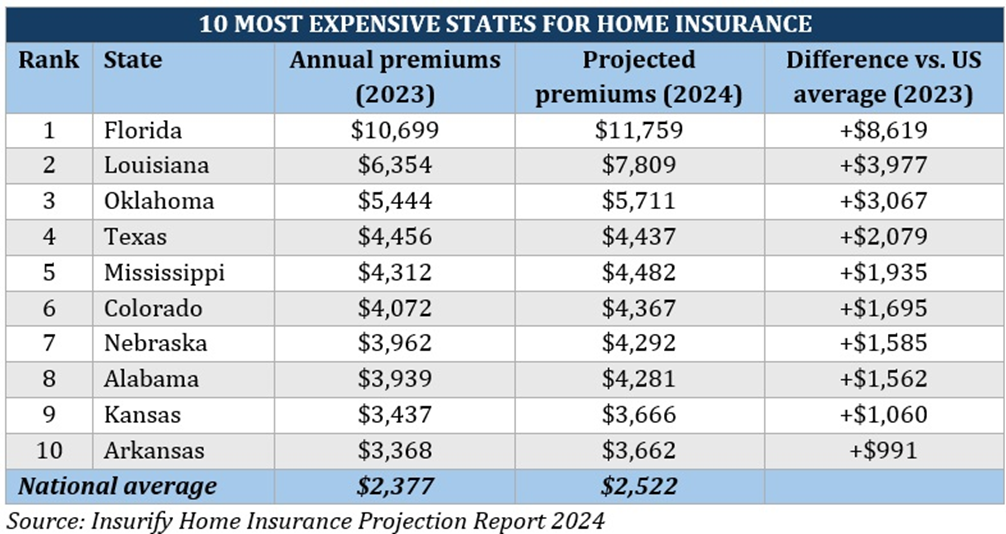

Several factors contribute to the upward trend in insurance costs. Climate change-induced natural disasters, such as hurricanes, floods and wildfires have become more frequent and severe. As a result, insurance companies face higher payouts for damages, prompting them to adjust their premiums accordingly. Additionally, the rising costs of both construction materials and labor further drive-up insurance rates, as insurers need to account for the increased expenses associated with property repairs and rebuilding.

Impact on Buyers

Rising insurance costs can significantly affect buyers’ purchasing power and affordability. Higher insurance premiums mean that buyers may need to allocate more of their budget to their insurance expenses, leaving them with less money for mortgage payments and/or other housing-related expenses. In some cases, buyers may find themselves priced out of certain neighborhoods due to the prohibitive insurance costs associated with them.

Impact on Sellers

Sellers are not immune to the effects of rising insurance costs, either. Higher insurance premiums may make it more challenging to sell a property, especially those located in high-risk areas. Sellers with properties in high-risk areas may find their properties languish on the market longer than expected or generate offers with lower sale prices as buyers weigh insurance costs when evaluating their purchasing options.

Strategies for Buyers and Sellers

There are things both buyers and sellers can do to help mitigate the insurance predicament. Buyers should work with an experienced insurance broker who can provide comprehensive quotes and explain the insurance coverage options available so they can assess the total cost of home ownership as well as ensure they have satisfactory coverage. Sellers should work closely with their real estate broker to develop a pricing strategy that reflects the current insurance landscape. Additionally, sellers should highlight any cost-saving features or recent upgrades that may lower insurance premiums which may make the property more attractive to potential buyers.

In conclusion, rising insurance costs represent a significant consideration for both buyers and sellers in today’s real estate market. By understanding factors driving these increases and implementing strategic measures, buyers and sellers can navigate these challenges effectively.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link