In the ever-evolving landscape of the American dream, homeownership has long been considered a cornerstone of financial stability and wealth accumulation. Yet, as we navigate the complexities of modern economics, the chasm between homeowners and renters continues to widen, painting a stark picture of inequality in wealth distribution. This analysis delves into the profound differences between homeowner and renter household balance sheets, examining the disparities in assets, debt, and net worth.

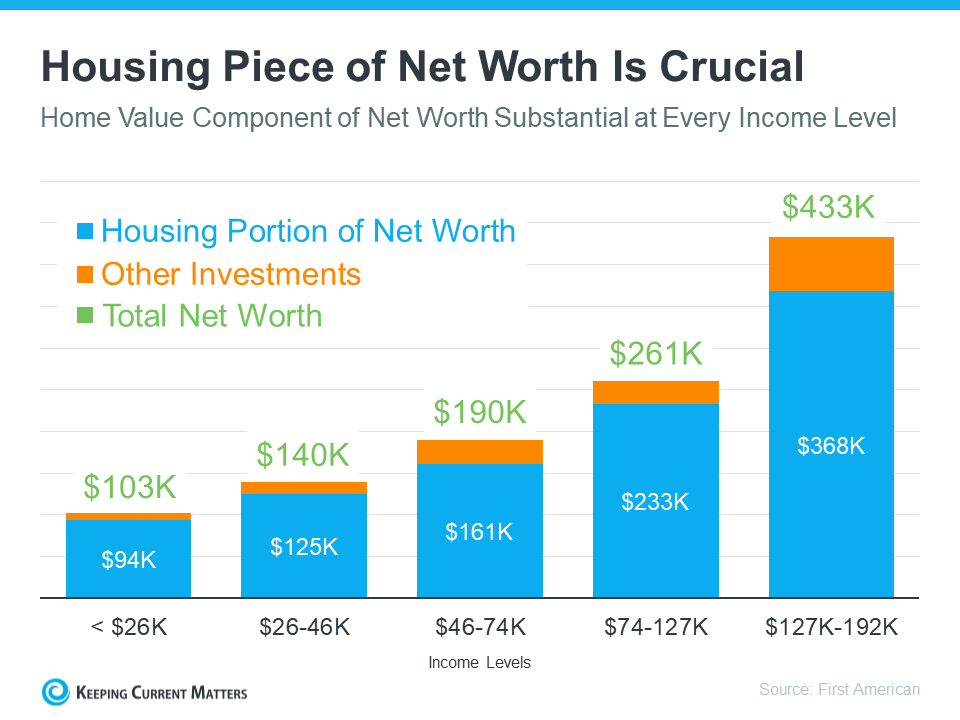

Image Credit: Keeping Current Matters | Source: First American

The Equity Equation

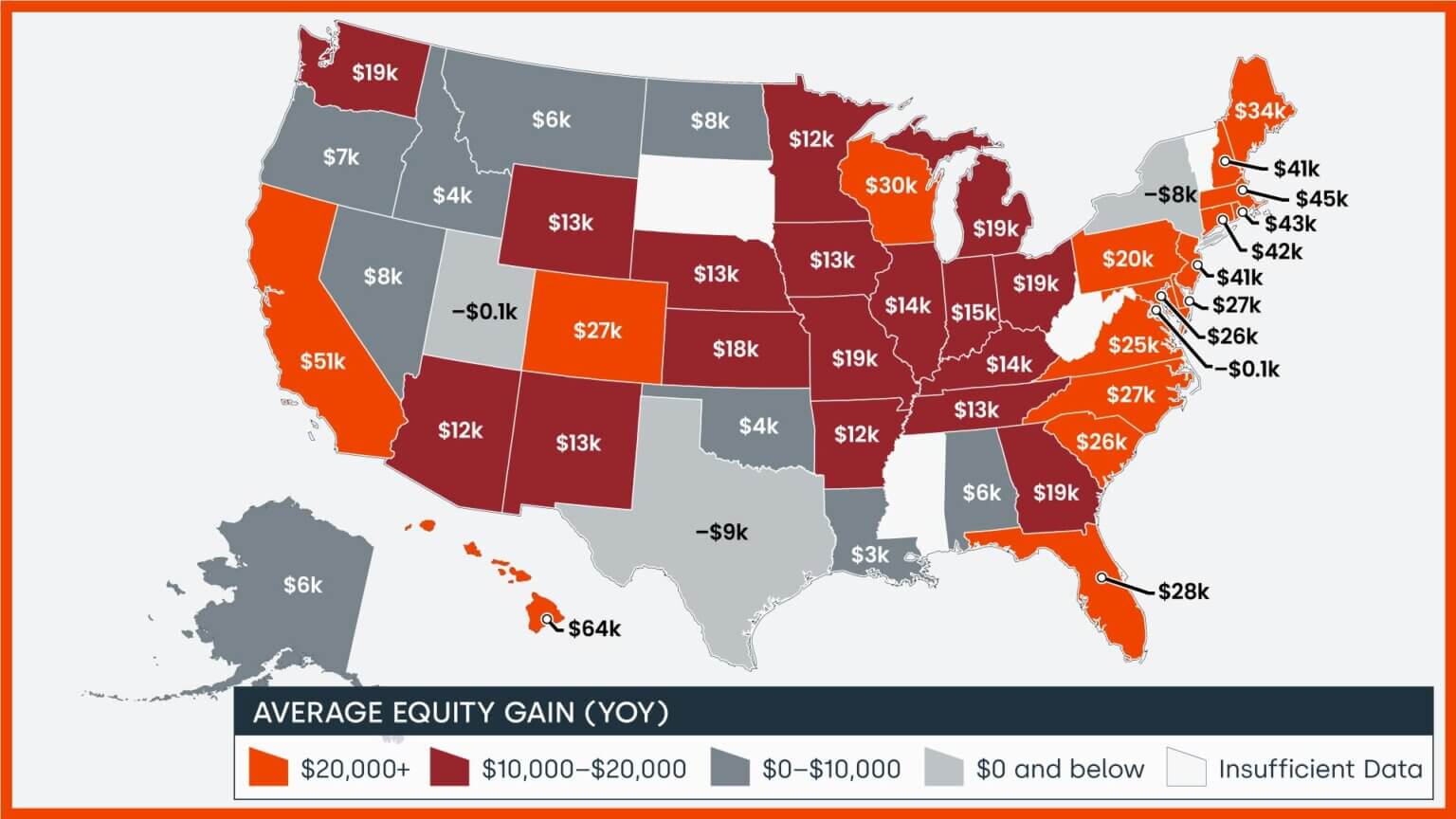

At the heart of this divide is the concept of equity. Homeowners, particularly those with mortgages, have witnessed a significant boon in their financial health, courtesy of the real estate market’s upward trajectory. CoreLogic’s homeowner report for the third quarter of 2023 illuminates this phenomenon, revealing a collective equity increase of $1.1 trillion among U.S. homeowners—a 6.8% rise from the previous year. This equity isn’t just a number; it’s a lifeline to financial security, offering homeowners a tangible asset that appreciates over time.

Image Credit and Source: CoreLogic | Average home equity changes by U.S. state year over year, Q3 2023

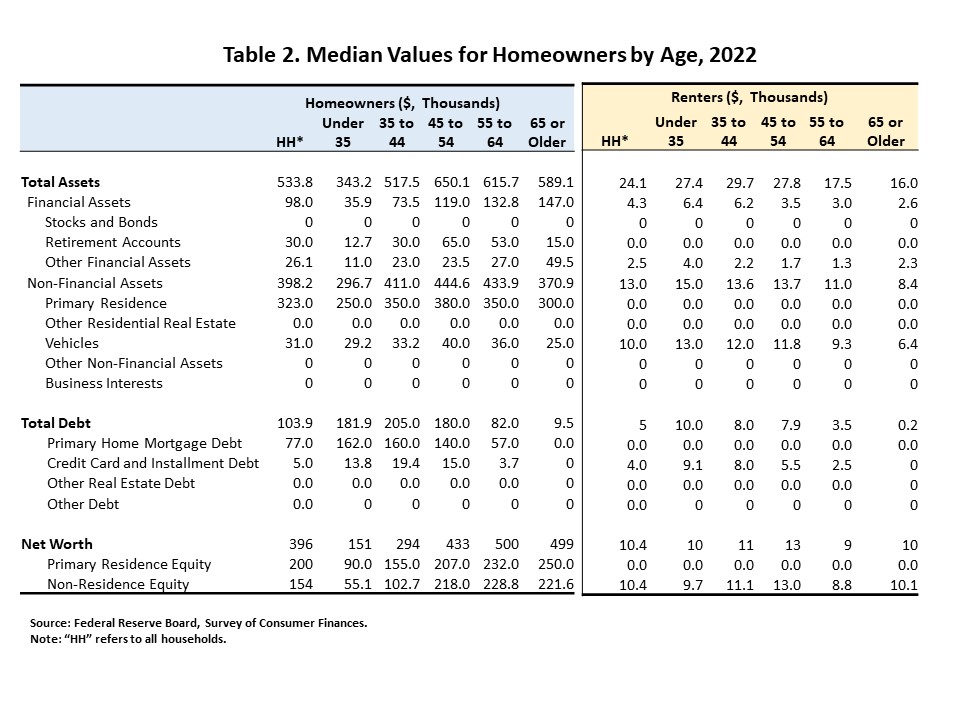

Contrastingly, renters find themselves on the opposite end of this spectrum. Without the ability to build equity through property ownership, they miss out on the wealth generated by home price appreciation. This absence of primary residence equity, coupled with typically lower holdings in other assets, places renters at a significant disadvantage in wealth accumulation.

Beyond the Home: Diversifying Assets

The disparity extends beyond the walls of a home. Homeowners often boast a diversified portfolio of assets, further cementing their financial standing. While primary residence equity forms the bulk of their wealth, many homeowners also invest in other financial instruments, contributing to a more robust financial safety net.

Renters, however, face a different reality. While more than half may own some financial assets, their portfolios do not grow substantially with age. This stagnation, coupled with a lack of substantial investments in retirement accounts or other non-financial assets, underscores a pervasive issue: the inability of renters to accumulate wealth over time, especially as they approach retirement.

Bridging the Gap: The Role of the Rental Market

While the benefits of homeownership are clear, it’s important to recognize the role of the rental market in the broader economic landscape. Nearly nine out of ten households will experience both renting and owning at different stages of their lives. The rental market, therefore, serves as a crucial stepping stone for many, providing housing flexibility and saving opportunities for future homeownership.

However, the transition from renter to homeowner is fraught with challenges, exacerbated by rising housing costs and economic uncertainties. 82% of renters say home prices are too high, and nearly half (45%) of them report they would be likely to buy a home if prices lowered. This transition is more than a financial leap; it’s a fundamental shift in wealth-building potential and long-term security.

Conclusion: A Path Forward

The divide between homeowners and renters is more than a matter of housing preference—it’s a reflection of a broader economic disparity that affects millions. As policymakers, communities, and individuals grapple with these issues, the goal remains clear: to create a more equitable path to financial stability, where homeownership is accessible and renting is a choice, not a necessity.

In this pursuit, education plays a pivotal role. Understanding the long-term benefits of homeownership, coupled with strategic financial planning, can empower individuals to make informed decisions that align with their wealth-building goals. As we move forward, the dream of homeownership, and the financial security it brings, should be a realistic and attainable goal for all.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link